One of the most important things a filmmaker can ask for on-set is peace of mind. No matter the size of the shoot, there are a lot of moving parts and plenty that can go wrong.

With equipment, sets, talent, and crew to worry about, knowing you have a good production insurance policy ensures that no matter what happens, the show can go on.

Once you’ve got that covered, you can focus on the 2nd most important thing- what kind of snacks you’ll have on the set (but that’s for another article).

Your insurance policy should be set up before filming starts. The policy should cover exposures such as theft, accidental property damages, injury to spectators, injury to cast and crew members and more. If you’re shooting with animals (or bringing dinosaurs back to life), there are add-on policies for that!

Production insurance can be confusing, so we put together this simple but comprehensive guide to walk you through the finer points of picking a policy. Hopefully, by the end, you’ll be an expert, or at least not visibly cringe when you hear the words “deductible” and “premium.”

- What is Film Production Insurance?

- Why Do You Need Production Insurance?

- What Types of Production Insurance Policies Are Available?

- Who Buys Film Production Insurance?

- What Does Film Production Insurance Cover?

- What is Errors and Omissions Insurance?

- How Much Does Production Insurance Cost?

- What's the Difference Between Short-Term Production Insurance and Annual Production Insurance?

- What is DICE Insurance?

- What You Should Know When Purchasing DICE Insurance

- What is an Entertainment Insurance Broker?

- What are the Best Questions to Ask an Entertainment Insurance Broker?

- How to Get Film Production Insurance?

- What to Know About Equipment Coverage?

- What is an Insurance Deductible?

- Understanding Your 24/7 Certificate Insurance?

- What Should You Know About Gear Rental Insurance?

- What is Worker's Compensation Insurance?

- What is General Liability Insurance?

- What Should You Know About Add-On Specialty Policies?

- What Separates Good Film Production Policies from Bad Production Insurance Policies?

- The Final Cut

- What makes Athos Insurance Better than the Rest?

What is Film Production Insurance?

Film Production Insurance protects production companies and film projects from liabilities related to production by covering a specified dollar amount in the event of an insurance claim.

Production insurance covers your production activities, but you'll have to pick which coverages you want to purchase. For example, some productions may only need to rent equipment, and will not rent a space or location. These productions may only need equipment coverage. For productions renting locations or needing permits, they will need general liability insurance to cover this exposure.

Workers’ compensation covers injuries to cast and crew, including independent contractors (General liability insurance does not cover injuries to your cast or crew). If a vehicle is being rented, you'll need to add on Hired and Non-owned Auto liability and physical damage coverage. This is an add-on to a General Liability insurance policy.

Why Do You Need Production Insurance?

A well-written film production insurance policy will protect filmmakers from the exposures associated with their shoot while filming, or at any time on set, including accidents when working with vehicles.

It’s also important to cover any possible thefts or accidental damages as well. Producers carry a lot of the responsibility for every person and piece of equipment on set. Depending on the needs of the specific production, the right insurance policy will protect you from various risks, including:

- 3rd Party Bodily Injury

- Damage or Theft of Rented Equipment

- Injury to the Cast or Crew

- Damage or Theft of Rental vehicles

- Damage or Theft of Drones

- Damages to Rented Location Property

There are other risks that may be covered as well. You always want to choose the coverage that fits your needs. You’d be surprised at some of the things we’ve seen happen!

What Types of Video and Film Production Insurance Policies Are Available?

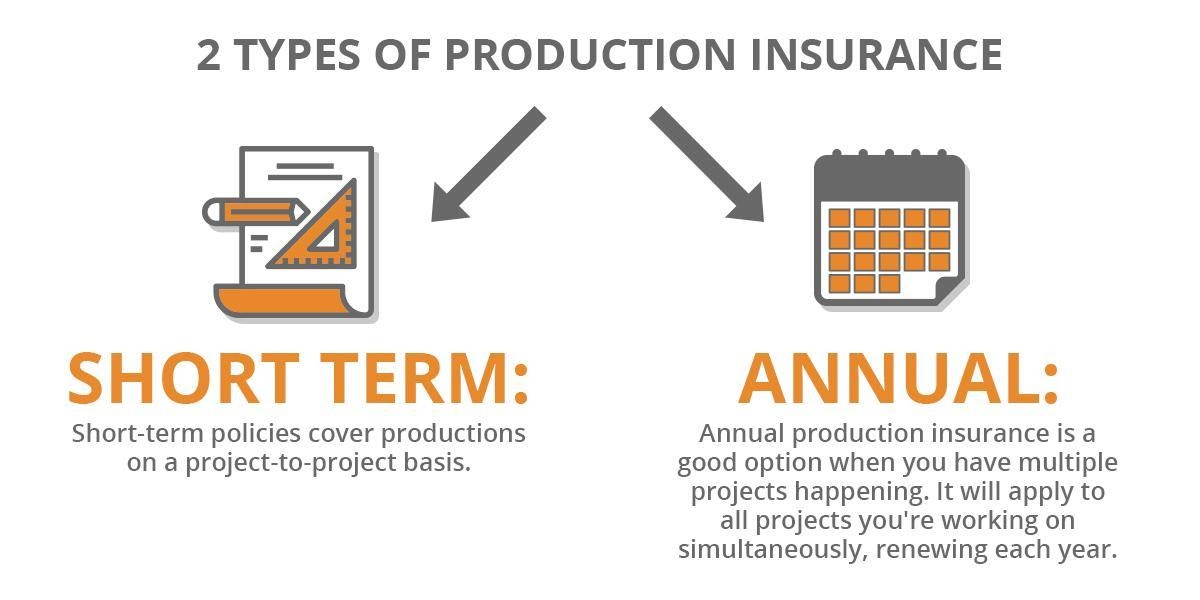

Most often, video production insurance comes in two forms; short-term production insurance, and annual production insurance.

Short-term production insurance policies cover one single project. They’re flexible and can include one day of production, or up to one year. Your favorite music video where the guitarist jumps off the roof into the pool?

They probably had a short-term policy. When purchasing a short-term policy, be sure to include prep days in your coverage. (Also maybe don’t jump off any roofs).

Annual production insurance is a good option when you have multiple projects happening. An annual policy is meant to cover multiple projects throughout the year and can be renewed each year. An annual policy is recommended if you have at least 4 productions within 12 months.

Who Buys Film Production Insurance?

Any individual or company producing a major or minor film, TV show, or commercial that involves a cast, crew, and/or set, should have production insurance. The premium costs vary, based on the length and scale of the project, and the specific coverages needed. Obviously, you don’t need an insurance policy before picking up your phone to film your puppy with the zoomies. But anyone filming anything professionally needs insurance.

Often, due to laws and regulations, you’ll be required to have a certain minimum coverage amount, regardless of the size and needs of your production. An insurance agent can help you find a policy that fits the needs of your production and satisfy these requirements. It can be complicated and it’s better to have an agent who can walk you through it.

We’ll cover these more specifically in the next section, but the most common types of production insurance are:

- General Liability

- Equipment coverage

- Errors and Omissions

- Non-Owned and Hired Auto Liability and Physical Damage

- Workers Compensation

What Does Film Production Insurance Cover?

Since no two film projects are the same, no two production insurance policies will be the same. An experienced insurance broker will know how to tailor each policy to your project or company's specific needs. It’s really helpful to get an expert involved, especially when some of the coverage becomes more technical than you care to get into. You shouldn’t need a master’s degree in production insurance to be able to buy the right policy.

A policy can cover many things, such as accident-related liability, injuries on set, theft, loss, or damage to owned or rented equipment. Some policies protect producers from copyright infringement. All kinds of fun stuff! We’ll talk about this more below.

What is Errors and Omissions Insurance?

Errors and Omissions insurance protects your production company against claims of unauthorized usages, such as someone suing you with a claim that you stole their idea. This type of coverage includes characters, titles, copyrighted materials, plots, ideas, and various forms of plagiarism. So when your crazy aunt Betty sues you, saying that the crazy Aunt Bonnie character in your movie was based on her, you’re covered! (Next time, maybe name her Aunt Lucy?)

E&O insurance also covers you against claims of unfair competition, invasion of privacy, and defamation. Because of the nature of this type of insurance, you may need an attorney's assistance to help review and clear all the content you're using in your film first. An attorney will help review release agreements, distribution agreements, services agreements, and more.

Production companies generally need some form of Errors and Omissions insurance.

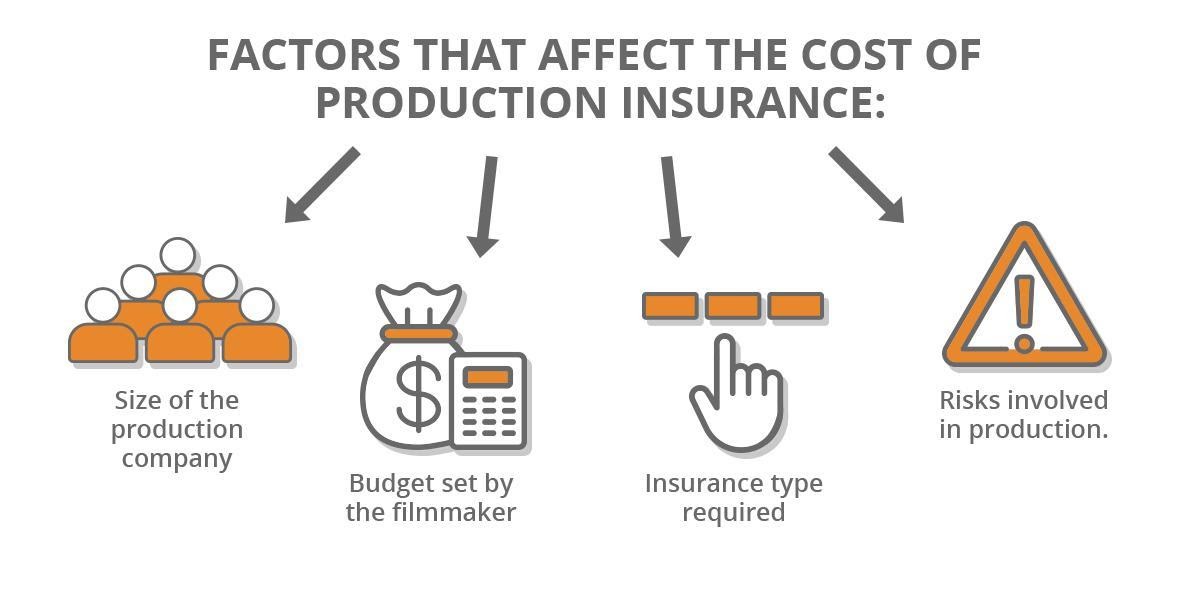

How Much Does Production Insurance Cost?

This is the “million-dollar question!” Luckily, it probably won’t be a “million-dollar answer.” But unfortunately, there’s no standard price list. Each policy is different, policy prices largely depend on the specific needs of the production, and whether the policy is either short-term or an annual production insurance policy.

Other factors that affect cost include:

- Scale and activities of the project

- The budget of the film

- Insurance coverages needed

- Length of production

- Risks involved in the production.

- Values of Rented Equipment on set

While the prices vary by policy, there are some numbers that can help provide a general idea of what your policy might cost.

Short-term film productions have policies that start around $390 and increase depending on the factors we discussed above. Annual or DICE policies (more on that below) often have premiums that range from $1,450 to $2,500 or more. So the scene where the grandmother skydives in for the wedding may drive up the cost just a bit.

Your premium will be a direct result of what you choose to cover, and the minimum premiums set by your provider.

Hopefully, these numbers, though just average starting points, can give you a better idea of what the cost of insurance might look like for your production.

What's the Difference Between Short-Term Production Insurance and Annual Production Insurance?

Short-term policies cover one project, and annual insurance policies are meant to cover multiple productions within the same year. We go over this in more detail in the “Types of Insurance” section above.

One exception to this rule is Feature Film Insurance. Feature Film Insurance is usually written on an annual basis but it is only meant to cover one project. This is often surprising to filmmakers, so it’s important to note.

What is DICE Insurance?

DICE stands for:

- Documentaries

- Industrial

- Commercial

- Educational films

DICE Production is the correct business classification when setting up annual production insurance. It represents the type of policy that provides pre-arranged coverage for the specialized production categories over the timespan of one year.

DICE insurance can cover documentaries, industrial films, commercials, educational films, music videos, and other types of short films. Longer-term productions like Feature Films, Television Series, Reality TV, and occasionally Short-Films, require separate policies.

However, some insurance carriers include feature films and short films in their DICE coverage program, but it depends on the budget and the type of content.

Are you still feeling a little confused about DICE insurance? Don’t worry! We have a breakdown and complete list of types of productions that are covered by DICE policies for you:

- Animation

- B-Roll

- Behind the Scenes

- Cell Phone/Mobile phone

- Commercial

- Community TV interview

- Corporate Video

- Demo Reel Shoot

- Digital Video

- Direct Sale Videos

- Director's Reel

- Documentary

- Editing

- Educational

- Experimental Film

- Film Festival Reel

- Independent Feature, low budget

- Industrial

- Infomercial

- Instructional

- Internet Production

- Live-Action Shots

- Miscellaneous Productions

- Music Video

- Non-Airing Pilot

- Photography Shoot

- Pick-Up Shoot

- Point of Sale Video

- Post-Production

- Pre-Production

- Productions for miscellaneous mediums

- Promotional

- Public Access Program

- Public Service Announcement

- SAG Experimental

- SAG Modified Low Budget

- Sales

- Video

- Short-Film

- Soap Opera

- Spec Commercial

- Spec Production

- Student Film

- Thesis Film

- Trailer

- Training Video

- Video Biography

- Video Game Shoot

- Video Location Survey

- Video Shoot (miscellaneous/other)

What You Should Know When Purchasing DICE Insurance:

When purchasing DICE insurance, there are a few things that you should clarify with your broker or insurance provider.

First thing’s first, make sure that your business is classified correctly.

Be as transparent as possible when discussing your business operations and coverage needs. Leaving out some seemingly minor details may feel harmless, but could lead to denial of your coverage.

Also, keep in mind that videographer and photographer insurance are not in the same class as the DICE production companies. Rates for these roles are typically cheaper since they target companies that operate on a smaller scale.

Think of family portrait studios and people filming private events, like weddings, birthday parties, and baby showers. If you dabble in both DICE work and small-scale private events, then you should get a DICE policy.

The Photographer and Videographer class by itself does not cover DICE production activities. When it comes to liability, if you don’t get the right insurance, you’re really rolling the, um, dice.

What is an Entertainment Insurance Broker (or Agent)?

To purchase entertainment insurance, you’ll generally work with an entertainment insurance broker or agent. However, some insurance carriers do have direct online policies, but these policies can be complex, and you could end up paying for coverage you don’t need.

You’ll want an entertainment insurance agent who can walk you through the process when something unusual comes up. They can be your tour guide in the wilderness of purchasing an insurance policy.

Your insurance broker or agent will give you recommendations on coverage and will package your policies. It’s important to choose a knowledgeable and diligent entertainment insurance agent since they can help you get the best policy at the best rate.

Equally important is choosing an agent who specializes in entertainment insurance, since they understand the needs of the industry. An entertainment insurance broker who is inexperienced may set up your policy incorrectly or create long delays, which can affect your production timeline. The last thing you want is a delayed production because your friend’s sketchy insurance broker uncle got you the wrong policy.

What are the Best Questions to Ask an Entertainment Insurance Broker or Agent?

Finding the right entertainment insurance broker or agent isn’t complicated when you know the right questions to ask.

Start with these:

- How many years of entertainment insurance experience do you have? (If they say zero, run!)

- Which insurance carriers do you place business with? Are they designed for the entertainment industry?

- What's your process for placing business?

- What is your turnaround time?

- How do you service your clients?

How Do I Get Film Production Insurance?

You can usually apply online pretty easily, but working with an agent or broker is always a better bet. They can help you navigate the process and choose the best policy for your needs. Most short-term production insurance policies are not refundable, so it’s best to finalize your shoot before activating your policy.

Remember: Never start your production without an insurance policy in place. Confirm your policy dates, coverages, and production activities, and inform them immediately if anything changes from your original application. Starting production without an insurance policy would be like leaving for a road trip without car insurance.

What About Equipment Coverage or Gear Insurance?

Equipment coverage or gear coverage is one of the most critical aspects of production insurance policies. You’ll want to make sure your expensive equipment is covered at all times – from moving it on-set, going to and from the set, and while in storage.

Your policy should cover camera equipment and accessories, grip and lighting gear, sound equipment, and all other related production gear. Most production rental houses will, at the very least, require you to cover the replacement value of the equipment you’re renting from them, and some may require a $250,000 to $500,000 minimum coverage.

Some Important Tips for Equipment Coverage:

- Know your policy coverages and any exclusions before you get to set, to avoid unexpected out-of-pocket expenses.

- Before signing your policy, ask your broker about optional equipment coverages. These cost extra but could save you money in the long term, depending on your risks.

- Always keep an equipment list handy, and continue to update it as things change. This helps to inventory all equipment if you ever have a claim.

What is an Insurance Deductible?

A deductible is the amount of a claim that you pay before the insurance kicks in. In the event of a claim, the deductible is subtracted from your total claim payout amount. For example:

The total claim payout is $10,000

Deductible: $1,000

The insurance carrier would write you a check for $9,000.

Some insurance policies have lower deductibles, such as $250 or $500. Many insurance carriers will provide deductible options, which gives you the flexibility to adjust the deductible to an amount you are comfortable with. Often, choosing a higher deductible will give you a lower premium.

Understanding Your Options for 24/7 Certificate Issuance

If you have an equipment insurance policy through an agency with online servicing capabilities, you can issue certificates of insurance through your customer portal at any time, as long as your policy is active. In just a few steps, you'll be able to create a digital certificate that you can then send to your vendor quickly and easily. It’s 2021, why shouldn’t creating a digital certificate be as easy as ordering Pad Thai?

What Should You Know About Gear Rental Insurance?

One of the biggest factors in almost all productions is the equipment needed to get the job done. You know better than anyone how expensive production equipment is.

Whether you are renting equipment from a rental house or hiring contractors who own their gear, you will need to make sure all of the gear on your set is covered against accidental damages and theft.

Your gear insurance policy will have a maximum coverage limit on it. This limit is the total amount of insurance that is available for ALL the equipment on the film set, and not the maximum limit available per rental house. Talk to your broker about the risks of under-insuring the gear that you rent. Be sure to know the replacement cost value, and ensure that it's covered within your policy.

Make it a point to double-check the insurance requirements of rental houses, as some require additional liability policies when you rent their equipment.

What is Worker's Compensation Insurance?

Workers’ compensation insurance is necessary for just about any business in any industry, and production is no different. Workers’ compensation insurance provides coverage for employees you hire as cast and/or crew (including 1099s) for production-related injuries or illness.

Workers’ compensation can be purchased as part of a production policy package, through an entertainment payroll company, or your state’s workers’ compensation fund.

Workers’ compensation will cover your employees’ medical costs of work-related injuries, and paid time off if their injuries prevent them from working.

What is Production General Liability Insurance?

Production General Liability Insurance is a great starting point when shopping for production insurance. Production General liability insurance provides coverage for bodily injury to third parties. Third parties are non-cast and non-crew members such as bystanders or spectators.

For example, let’s say your production company is filming at a museum and has taped electrical wiring onto the floor. A museum visitor walks by, trips over the wiring, and breaks an arm. This bystander can sue your production company for bodily injury. General Liability protects you from this.

General liability insurance is vital for every producer to have before a shoot starts. For many production policies, general liability insurance is the foundation. Any productions shooting on location, in a venue, or working with a city and permit office will likely need general liability coverage.

Athos’ Equipment Liability Insurance offers special liability insurance for rental houses that require general liability coverage in case of third-party bodily injury caused by the use of the rented equipment. See! We’ve thought of everything!

What Should You Know About Add-On Specialty Policies?

Add-On Specialty Policies are extensions of the standard policy that you're purchasing or already have set in place. They typically cover items or needs that aren’t considered “standard.” For example, you may find that you want to add accident medical insurance to your general liability policy to increase coverage in the event that someone becomes severely injured on set.

Disability insurance is another helpful add-on policy that protects an employee’s income if a disability prevents them from working.

What Separates Good Film Production Insurance Policies from Bad?

There are red flags to look out for when shopping for production insurance to avoid buying a bad policy. Like dating, a red flag can seem minor at first, but can hurt you later!

Look for an insurance broker or agent that:

- Specializes in entertainment insurance

- Provides quality customer service

Every policy will have different provisions and exclusions. Make sure to talk with your broker so you understand your policy’s limitations. If an exclusion on a policy won’t work for you, your insurance broker may be able to find another policy or insurance company that’s a better fit.

Your insurance policy limits should be enough to cover the replacement cost of the property that is covered and should meet any insurance requirements you may have from your vendors, location owners, and film permit offices.

Finally, your insurance carrier should be aware of everything involved in your project, from drones and stunts to hazardous activities like underwater filming. If they can't cover all these activities, you’ll have to find another carrier. Otherwise, you’d have to cancel the cool stunts, and what fun is that?

The Final Cut

Whether you're shopping for production insurance for the first time or the 100th time, taking the time to get the right insurance policy is the best way to ensure peace of mind when you get to the set. As we’ve said, peace of mind is the number one priority, just ahead of snacks.

That’s what we are here for! Here at Athos, peace of mind is our specialty. With 24/7 customer support, you can call, email, or chat with a live entertainment insurance expert who can answer any questions you might have.

What makes Athos Insurance Better than the Rest?

At Athos Insurance, We:

- Are experts in entertainment insurance. It’s what we do!

- Make it easy for you to get a tailor-made policy online instantly at the best prices possible

- Offer all lines of production insurance

- Our fast, friendly, and affordable

- Are known for our excellent Customer Service - reach out to us during business hours via phone, email, or live chat!

Still have questions about covering your next big project?

We are here for you, always! Contact us with a question via phone at 626-716-9800 or email service@athosinsurance.com

That’s a wrap!